Chinese CNC Plasma Cutters vs. International Brands: Performance Comparison

The performance of Chinese-made CNC plasma cutters has significantly improved in recent years, now approaching international brand standards in stability and cutting quality. While domestic equipment was often questioned for reliability in the past, many key components (such as solenoid valves, pressure reducing valves, servo systems, etc.) now use imported configurations to ensure quality. Overall, differences exist between Chinese and foreign equipment in the following areas:

-

Cutting Quality and Precision: High-end international brands (e.g., Hypertherm) still hold an edge in detail accuracy and cut quality. Their unique system design and fine plasma technology (like Fine Cut) enable better kerf, less dross and slag, faster cutting speeds, and higher precision in corners and small holes. In comparison, most Chinese plasma cutters meet general industrial precision requirements. However, when cutting complex contours or hard materials, the perpendicularity and finish of the cut are slightly inferior, requiring more post-cut grinding. It’s worth mentioning that Chinese manufacturers are also developing "Fine Plasma" systems, such as Huayuan’s SLG series, which improve precision through water-cooled torches and current waveform control. Nevertheless, the overall technical maturity still lags behind the top levels of companies like Hypertherm.

-

Consumable Life and Operating Costs: Consumables for international brand plasma sources generally last longer. For example, the electrode tip life of a Hypertherm torch can be several times that of domestic consumables. User tests show that when cutting the same 1/2-inch steel plate, consumables supplied with domestic machines last less than 1/5th the lifespan of Hypertherm consumables. In other words, domestic plasma consumables are cheaper per unit but have a shorter lifespan, requiring more frequent replacement. Imported plasma consumables, while more expensive, are more durable and require less frequent replacement. In the long run, domestic machines have lower initial investment and cheaper consumables, offering high overall cost-effectiveness. However, in high-volume production, frequent consumable changes and downtime can increase hidden costs. As one overseas user described: "Chinese plasma is like an economy car, Hypertherm is like a Mercedes-Benz," highlighting a tiered difference in initial cost and performance.

-

Stability and Duty Cycle: For low to medium-intensity daily processing, Chinese-made plasma machines generally operate stably, with cutting performance "relatively stable" and not far behind imported products. However, under high-load continuous operation, international brands excel with higher duty cycles and superior cooling designs. For instance, American units like Lincoln and Miller can often work at high speeds for extended periods without triggering thermal protection. Some cheaper domestic machines may experience unstable operation or faster component aging under intensive workloads. Therefore, for heavy industrial scenarios requiring long-duration operation, the reliability of international brands is more assured.

-

Ease of Use and Control Systems: Many domestic CNC plasma cutters use proprietary or open-source CNC systems. Functionally, they can handle basic programming and automatic height control (AHC). However, they are slightly inferior to high-end foreign systems in terms of user interface (HMI) friendliness and software integration. Some users report that certain Chinese laser/plasma equipment has non-intuitive interface designs and lacks convenient features. For example, some machines cannot switch worktables directly from the console, requiring manual operation, or lack automatic diagnostic alarm functions. In contrast, CNC systems provided by companies like Hypertherm are typically more comprehensive (e.g., automatic gas control, graphical programming interface), making training easier. Additionally, Torch Height Control (THC) is a key function for ensuring cut quality. Most Chinese equipment now comes standard with capacitive or arc voltage THC for automatic height adjustment, which is essentially the same as foreign machines. However, high-end foreign systems offer superior height control precision and response speed, resulting in more stable arcs and lower consumable wear during cutting.

In summary, Chinese CNC plasma cutters offer outstanding cost-effectiveness. For small and medium-sized enterprises (SMEs) and budget-conscious users, domestic machines provide "over 80% of the performance at only about one-third of the price." However, for scenarios demanding extreme cutting quality or heavy-duty continuous production, international brands maintain a clear advantage due to longer consumable life, finer control, and more comprehensive after-sales service. A compromise solution often recommended by industry insiders is to purchase a low-cost domestic CNC cutting table but pair it with an imported plasma power source and torch (e.g., Hypertherm). Practice shows this combination significantly improves cutting speed and quality while keeping the total cost lower than a fully imported system. This approach is frequently adopted by overseas buyers.

(Table: Brief Comparison of Domestic vs. Imported CNC Plasma Cutting System Performance)

| Performance Aspect | Chinese CNC Plasma Cutter | International Brand Plasma System |

|---|---|---|

| Cutting Quality & Precision | Meets most industrial precision requirements, but high-speed cutting of thick plates can produce significant bevel and dross. Fine plasma technology is emerging. Precision for very small holes and complex shapes is reduced. | Smooth, vertical cuts with minimal dross. Equipped with FineCut and other fine technologies, excelling in small hole and sharp corner quality. Cut surfaces approach laser quality. |

| Stability & Lifespan | Suitable for medium-intensity work. Key components often use imports to ensure reliability. Consumables are cheap but have a shorter lifespan, requiring frequent replacement. | Robustly designed for durability, stable under long-term full-load operation. Consumables last longer (generally multiples of domestic). Longer cutting runs per session, less downtime. |

| Operation & Functionality | Basic CNC functions are complete, supporting AHC, etc. Interface and software are relatively simple, lacking some user-friendly details. After-sales service relies on agents or remote factory support. Limited English technical documentation. | Advanced control systems with comprehensive features (automatic gas control, process libraries, etc.). User-friendly interface. Timely technical support, training, and comprehensive documentation provided by the manufacturer or local agents. |

| Price & Cost | Price is only a fraction of imported equipment, low initial investment. Suitable for workshops or enterprises with limited budgets. Low per-cut cost. Total consumable expenditure may be slightly higher but overall economic efficiency is good. | High purchase cost, but high long-term reliability. Efficiency and quality advantages can reduce downstream processing and maintenance costs. High brand value retention and good liquidity in the second-hand market. |

Application Performance and Suitability in Different Industries

Chinese plasma cutters are widely used across multiple industries, demonstrating good overall suitability. Based on the characteristics of plasma cutting (high speed, high-temperature plasma arc cutting metal), their typical applications and effectiveness in various industries are as follows:

-

Sheet Metal Processing Industry: Plasma cutting is a common tool in medium-thin sheet metal processing. Domestic CNC plasma cutters can efficiently cut carbon steel, stainless steel, aluminum, and other sheet materials. Compared to flame cutting, plasma cutting causes less thermal distortion, offers higher precision, produces cuts with minimal dross and a good surface finish. In many cases, parts can proceed directly to assembly without secondary processing. Sheet metal shops frequently use domestic plasma machines for blanking various enclosures, metal cabinets, ventilation duct plates, etc. For plates below 15mm thickness, domestic machines can generally meet precision requirements of around ±0.5mm. For plates above 6mm (medium thickness), plasma is often more suitable than flame cutting for batch processing due to its speed and reduced distortion. For very high-precision small holes or complex patterns (e.g., high-end stainless steel decorative panels), laser cutting offers better precision but at a higher cost. Overall, domestic plasma cutters are renowned in the sheet metal industry for being economical, efficient, and compatible with a wide range of materials, making them suitable for sheet metal products with general precision requirements.

-

Construction Machinery and Agricultural Machinery: These industries involve cutting thick steel plates and profile components, such as excavator chassis plates and tractor frame parts. Traditionally, thick plates were cut by flame. However, flame cutting is less efficient for plates >6mm and offers poor cut precision. Domestic high-power plasma cutters (e.g., 200A, 300A models) can cut 20-40mm carbon steel plates, achieving faster speeds and better perpendicularity than flame cutting. For example, some domestic fine plasma machines maintain low dross levels even on 25mm plate thickness. For typical 6-20mm plates in construction machinery, many enterprises prefer plasma for its fast blanking speed and acceptable edge quality. Chinese-made gantry plasma cutting machines can be equipped with multiple torches for simultaneous processing, increasing capacity for large structural parts. These machines are highly prevalent in domestic construction machinery factories and are also exported to steel structure and machinery factories in Southeast Asia, the Middle East, etc. Overall, domestic plasma cutters offer sufficient power, simple maintenance, and can meet the durability and efficiency requirements of field construction companies or medium-sized factories. They have earned a reputation for being "rugged, durable, and affordable" in the construction/agricultural machinery sector.

-

Shipbuilding Industry: Shipbuilding has enormous demand for steel plate cutting, including complex contour cutting and hole cutting for hull segments. Large domestic shipyards often have mixed cutting workshops equipped with flame, plasma, and laser machines, selecting the process based on plate thickness. Among these, domestic CNC plasma cutters are mainly used for blanking medium-thickness (5-30mm) ship plates. Compared to traditional flame cutting, plasma cutting reduces plate thermal distortion, improves cutting quality, and lessens subsequent grinding work. Some underwater plasma cutting technologies are applied in shipyards, performing plasma cutting underwater to further reduce heat-affected zones and fumes. Chinese brands like Shanghai General (TAYOR) have considerable application in the ship cutting equipment market. Some domestic gantry plasma cutting machines are equipped with multiple torches for simultaneous cutting of multiple identical parts, improving shipyard production efficiency. In terms of suitability, domestic plasma is sufficient for structural parts with ordinary precision requirements in shipbuilding (e.g., bulkhead plates, deck openings). For components requiring extremely high dimensional accuracy (e.g., some high-value-added stainless steel ship parts), shipyards may prefer foreign fine plasma or laser equipment. However, for most marine carbon steel plate cutting, domestic plasma plays a major role with lower operating costs.

-

Metal Decoration and Art Industry: The decoration industry involves manufacturing items like signboards, metal letters, craft engravings, and guardrail patterns, requiring complex contour cutting of thin metal sheets. Domestic small CNC plasma cutters (including portable and benchtop models) are widely used in advertising signage and ornament production. These applications typically involve thin materials (<5mm stainless steel or aluminum) and pursue intricate pattern cutting. Plasma cutting, with its relatively wider kerf and larger heat-affected zone, has lower precision than laser for very fine patterns. However, for general text and graphics (e.g., fonts larger than 30mm), plasma is fully capable, and the equipment investment is far lower than laser. Many small and medium-sized metal craft workshops purchase domestic plasma cutters for making decorative items like artistic screens, hollowed-out lattice windows, and metal signs, due to their simple operation and low maintenance cost. Domestic equipment, combined with drawing software, allows cutting desired patterns with low operator skill requirements, making it very suitable for small-batch, diversified production in the decoration industry. It’s important to note that when cutting stainless steel decorative parts, the plasma cut edge may have very fine burrs, requiring simple polishing for a perfect finish. Overall, in the decoration and creative metal fabrication field, domestic plasma cutters are an entry-level choice for many enterprises due to high efficiency and low cost.

Beyond the industries mentioned above, domestic plasma cutters are also used in automotive repair, bridge construction, power equipment manufacturing, and other fields. For example, they are used in auto modification to cut chassis plates and in elevator manufacturing for sheet metal blanking. Notably, due to the flexibility and versatile processing capabilities of plasma cutters, many SMEs in developing countries tend to purchase Chinese equipment to handle various processing tasks. Users across different industries, from carbon steel to aluminum alloys, generally provide feedback that Chinese plasma cutters are "adequate and very cost-effective," fitting well with general processing requirements.

Of course, in some high-end manufacturing fields (e.g., aerospace precision parts, high-volume automotive parts production), where requirements for cutting consistency and automation integration are high, laser cutting or high-precision imported plasma systems are more commonly used. The penetration rate of domestic plasma in these areas is relatively limited. However, as domestic manufacturers continuously introduce advanced technologies and develop high-end machines, they are expected to show competitiveness in a broader range of industries in the future.

Global Market Performance of Chinese Plasma Cutters

Leveraging price advantages and increasingly improved quality, Chinese-made plasma cutters are occupying an increasingly important position in the global market.

-

Export Situation: According to industry data, the domestic market size for plasma cutters in China reached approximately ¥879 million RMB (about $120 million USD) in 2024. Moreover, a significant portion of Chinese production capacity is oriented towards export. Products from Chinese manufacturers are sold in over 80 countries across six continents and enter developed markets by complying with international certifications such as CE and CSA. For instance, companies like Shenzhen Jasic Technology (JASIC) derive over half of their revenue from export sales, having established sales networks in nearly 100 countries. Many distributors in Europe, the Americas, Southeast Asia, and Africa represent Chinese plasma cutting equipment, facilitating local procurement and service.

-

User Reputation: Among overseas buyers and end-users, the reputation of Chinese plasma cutters is polarized. On one hand, users widely recognize their good value for money. Many SMEs report that "with a budget equivalent to buying one European/American machine, we can equip two Chinese machines," which is very attractive for expanding capacity. For example, in Southeast Asian markets like Vietnam and Thailand, local manufacturers are keen to choose Chinese machines to reduce equipment investment. Statistics show that demand in the Asian market is growing rapidly, with China, India, etc., emerging as important consumer markets for plasma cutting equipment. On the other hand, some users in developed countries have concerns about the quality stability and after-sales service of Chinese equipment. This mainly stems from issues with some early low-cost models, leaving a negative impression. However, in recent years, mainstream Chinese brands have improved user satisfaction by enhancing designs and providing overseas technical support. Experienced technicians on foreign forums comment: "As long as low-priced plasma cutters are equipped with good components and properly maintained, they can perform the job well." Especially for small businesses with limited budgets seeking basic cutting capabilities, Chinese plasma cutters are often seen as a pragmatic choice of "good enough."

-

Market Share: Globally, European and American brands dominate the high-end market, but Chinese plasma cutters are continuously increasing their share in the mid-to-low-end segments. Europe holds about 40% of the global industrial cutting machine market share, North America about 20%, while Asia’s share is growing. As the "world’s factory," China’s substantial domestic demand has driven industry scale and cultivated numerous export-oriented enterprises. According to international market research data, the global plasma cutting machine market size was approximately $770 million USD in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2032. Chinese companies are striving to capture this growth dividend, leveraging price and production capacity advantages in emerging markets. Reports indicate that China is one of the world’s largest consumers of CNC flame/plasma cutting machines, with consumption growth rates exceeding the global average. In regions like Africa, South America, and the Middle East, driven by local industrialization and demand for economical equipment, Chinese plasma cutters often capture a large market share. Customs statistics show that China’s plasma cutter export value has grown for multiple consecutive years, with major export destinations including the US, Germany, Russia, India, Turkey, Brazil, UAE, and other industrial and emerging economies. It can be said that "Made in China" is becoming an undeniable force in the global cutting machine market.

-

Development Trends:

- Technology Upgrade: This is a key focus for Chinese plasma enterprises. In recent years, many manufacturers, through foreign cooperation or independent R&D, have launched inverter plasma power sources and fine plasma systems to enhance product competitiveness.

- Branding and Service Improvement: Large manufacturers are establishing overseas offices or cooperative service centers to accelerate response times for partners and improve user experience.

- Regional Market Focus: Markets along the "Belt and Road" initiative (Southeast Asia, Central Asia, Central and Eastern Europe) show high acceptance of Chinese products. Chinese plasma cutter market share is expected to further expand in these regions. In traditional European and American markets, as some Chinese brands obtain CE certification and promote through international exhibitions, they are also beginning to enter the SME user segment. Notably, some entry-level plasma models from Western brands are actually OEM-manufactured in China and sold under their brand names. This reflects that China’s manufacturing strength has gained global recognition and utilization.

In summary, Chinese plasma cutters are reshaping the global market landscape: achieving quality upgrades, with emerging markets like Southeast Asia, South America, the Middle East, and Africa as primary growth drivers, gradually solidifying a reputation for "high cost-performance"; while also penetrating mature markets like Europe and North America, providing overseas buyers with a strong alternative beyond European, American, and Japanese brands. In the coming years, with technological advancements and enhanced international marketing, the global market share of Chinese brands in plasma cutting machines is expected to continue rising.

Recommended Representative Chinese Brands/Models

Faced with numerous Chinese plasma cutter brands, overseas buyers often find it difficult to choose. Below are several representative Chinese manufacturers or product series, summarizing their characteristics, target users, and relative strengths/weaknesses compared to international brands for reference:

-

RILAND: One of China’s leading inverter welding and cutting equipment manufacturers. Its CUT series air plasma cutters (e.g., CUT-40, CUT-80) are popular in over 60 countries due to stable quality and solid performance. RILAND plasma machines use inverter IGBT technology, featuring compact size and high efficiency, suitable for small factories and repair shops. Compared to international brands, RILAND products offer exceptional value for money: the CUT-80, for instance, can cut 12mm steel plate on 220V single-phase power at about half the price of an equivalent imported machine. Its limitations lie in slightly weaker fine cutting capability and average heat dissipation reserves under continuous repetitive cutting. However, for general manufacturers, farms, and auto repair shops, RILAND provides a reliable, durable, and affordable option.

-

JASIC (Shenzhen Jasic Technology): A representative Chinese export-oriented welding and cutting equipment company, with exports accounting for about 54% of sales in 2023. JASIC’s inverter plasma cutters (e.g., CUT-70L6 series) are known for stable performance and simple operation. Machines feature full digital control panels and support multi-language interfaces, making them very suitable for direct sales to overseas end-users. JASIC machines offer precise output current, and cut straightness is excellent among domestic machines, having received praise in European markets as a practical choice. Its after-sales network covers Europe, the Americas, and Southeast Asia, providing local training and repair support. Compared to international giants, JASIC plasma cutters lag slightly in process intelligence (e.g., lacking some advanced piercing techniques) but are competent, moderately priced, and use common consumables. It is a Chinese brand recognized by both overseas distributors and end-users.

-

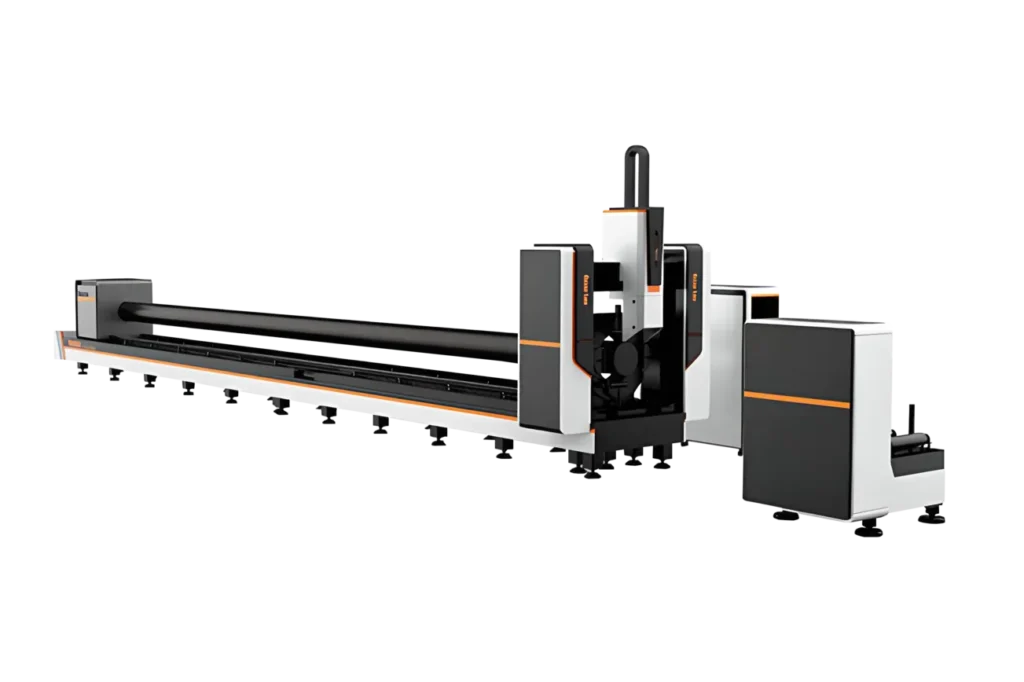

TAYOR (Shanghai General Heavy Machinery Co., Ltd.): Established in 1998, Shanghai General Heavy Machinery (brand TAYOR) is a major supplier of heavy-duty CNC cutting equipment in China. Its product line includes large gantry flame/plasma cutting machines, widely used in steel structure, shipbuilding, and other industries. TAYOR plasma cutting machines can be equipped with imported or domestic high-power plasma power sources, providing heavy-duty and efficient solutions. For example, the "TAYOR Gantry CNC Plasma Cutting Machine" can be equipped with two 300A plasma torches for simultaneous cutting of thick plates, significantly boosting productivity. The brand’s characteristics are rigid mechanical structure and high stability, suitable for factory users needing large-format cutting and simultaneous processing of multiple identical parts. Compared to international counterparts (e.g., Messer, Koike), TAYOR equipment has the advantages of low procurement and maintenance costs and strong parts commonality. Its disadvantages are lower software automation levels and a lack of some intelligent functions. However, for overseas large and medium-sized steel structure factories focused on economic practicality, TAYOR offers a high cost-performance integrated cutting solution.

-

AOTAI (Shandong Aotai Electric Co., Ltd.): AOTAI is a well-known domestic welding and cutting equipment manufacturer with products exported to Europe and America. AOTAI’s inverter plasma cutters incorporate European and American technologies in design, balancing reliability and performance. For example, its LGK series plasma power sources cover output currents from 60A to 200A, suitable for various applications from thin to thick plates. AOTAI models are characterized by refined processes: smooth and rapid arc ignition (some models feature HF-free start, reducing interference with surrounding electronics), and high current control precision, resulting in better quality at the start and end of cuts. AOTAI emphasizes safety and certification, with products holding CE, CSA, etc., and includes complete English manuals and operating instructions for overseas users. Position-wise, AOTAI plasma cutters are more suitable for users seeking certain quality on a limited budget: compared to Hypertherm, AOTAI is slightly inferior in consumable life and extreme performance but offers lower prices while achieving about 80-90% of the performance. It is considered by many overseas buyers as an "alternative to international brands."

-

Shanghai HG (Shanghai Hugong Electric Group Co., Ltd.) / Beijing TIME (Beijing Time Technologies Co., Ltd.): These are established Chinese welding and cutting equipment companies with state-owned enterprise backgrounds, holding stable market positions domestically. HG offers a wide range of CNC plasma cutter models, covering light-duty, industrial, and heavy-duty series. Its products are known for rich features, stable performance, simple operation, and high cost-effectiveness. For example, HG’s light industrial plasma cutters are highly integrated and can work immediately upon connecting to a computer, often purchased by overseas small businesses for daily metal processing. TIME Technology is renowned for high-quality welders; its plasma cutters have won awards at domestic and international exhibitions, featuring high digitalization and R&D investment in high-current plasma power sources. Due to their long history, these brands offer mature and reliable products, suitable for overseas customers who value product stability and reasonable prices. Compared to international brands, they lack cutting-edge technology points but deliver stable quality and fast after-sales response (with cooperative agents in some countries), belonging to trustworthy Chinese brands.

-

KENDE (Kende Electric Co., Ltd.) and Other Brands: Kende is one of the representative brands of low-cost welding and cutting equipment in China. Its plasma cutters are highly price-competitive, commonly found in the entry-level market and among individual users. The advantages of Kende plasma cutters are simple structure and low price, having penetrated markets in Africa, South America, etc., with extremely high cost-effectiveness. However, their functionality and lifespan are relatively limited, making them more suitable for light-duty use. Besides Kende, brands like Dalian Huagong Honeybee and Jinan Jiemai are also domestic manufacturers specializing in plasma/laser cutting machines, offering unique products in portable plasma cutters (e.g., Honeybee’s portable digital plasma cutter is popular in small overseas repair shops). These brands have their strengths, but overall, they provide economical and practical products, filling the gap left by international brands in the low-end market.

Summary: When selecting a Chinese plasma cutter brand, overseas buyers should focus on the manufacturer’s international certifications (CE, etc.), overseas agent situation, and typical user evaluations. Brands with rich export experience like RILAND and JASIC, having well-established global distribution networks, offer relatively more secure purchasing and service. For users requiring large cutting equipment, TAYOR, tested in the industrial field, can provide complete solutions. For startups and small workshops, the ultra-high cost-effectiveness models from brands like Kende might be a shortcut to quickly enhance processing capabilities. Of course, compared to international top brands, these brands still have gaps in intelligence and extreme performance. Buyers need to weigh the trade-offs based on their specific needs.

Conclusion: Are Chinese Plasma Cutters Worth Buying?

Through the above analysis, it’s evident that Chinese-made CNC plasma cutters have made significant strides in performance and application, winning widespread users globally. Regarding the question "Are they worth buying?", an evaluation needs to be made based on the buyer’s specific situation:

- If you prioritize cost-effectiveness and seek reliable metal cutting capabilities on a lower budget, Chinese plasma cutters are undoubtedly worth considering. They have proven capable of handling daily cutting tasks in numerous industries like metal processing and machinery manufacturing, and have accumulated a good reputation and many success cases in the export market.

- For SMEs and budget-limited buyers, Chinese models offer highly cost-effective production tools. As long as reputable brands are chosen and proper consumables and service are ensured, the productivity gains they bring will far outweigh the investment cost. In many overseas factories, domestic plasma cutters have enabled them to accomplish work previously requiring expensive imported equipment with less investment.

- However, if your production demands extremely high cutting precision, quality, and continuous operational reliability (e.g., aerospace, high-end manufacturing), or if you highly value localized after-sales service and long-term technical support from the manufacturer, then internationally renowned brands remain a more stable choice. The long consumable life, exceptional cutting quality, and comprehensive support systems offered by high-end brands are aspects that domestic machines currently cannot fully match in high-end applications.

Overall, the answer to "Are Chinese plasma cutters worth buying?" is: Yes, for most application scenarios. They offer sufficiently good performance at affordable prices, particularly excelling in areas like medium-to-low precision cutting of thick plates and high-volume general processing. As Chinese brands continue to improve their products and expand global service networks, overseas users can enjoy the convenience and value of "Made in China" in increasingly better ways. For overseas buyers and enterprise users, the key is to select a suitable model based on their specific needs: understanding both the advantages (cost, functionality) and limitations of the products, then making an informed purchasing decision. With proper selection and reasonable usage, Chinese CNC plasma cutters can indeed become an economical, efficient, and reliable asset on your production line.

References:

- Zhouxiang Welding Co., “Flame Cutter? Plasma Cutter? Which Should I Choose?” (2017) – Compares flame and plasma cutting precision and cost, explaining plasma cutting produces minimal dross, high precision, and is suitable for medium-thin plates.

- Wuhan Haichen Electromechanical, “Where is the Gap Between Domestic and Foreign CNC Plasma Cutters?” – Points out that current domestic plasma cutter performance is stable with no major gap compared to foreign ones, but some key components still rely on imports to ensure quality, reflecting the improvement and shortcomings of domestic machines.

- Practical Machinist Forum, “Need to buy a CNC plasma – Are the Chinese any good?” (2018) – Overseas users discuss the pros and cons of Chinese plasma cutters, emphasizing Hypertherm’s lead in consumable life and fine cutting, and suggesting pairing domestic tables with imported plasma power sources.

- Hobby-Machinist Forum, “Plasma Cutters” (2014) – User compares Chinese plasma and Hypertherm consumable life and repair service, likening domestic machines to "Yugo," highlighting cheap consumables but poor durability, requiring more spares and DIY maintenance, versus Hypertherm’s high quality and extensive service network.

- Report Hall, “2023 Top Ten Plasma Cutter Brand Rankings” – Lists well-known brands in the Chinese plasma cutter industry (Riland, Jasic, Hugong, etc.), provides business profiles and overseas sales network information for companies like Riland, showing the market position and global layout of domestic brands.

- Wiring a Hypertherm Torch for chinese plasma cutters – Plasma Cutters – Langmuir Systems Forum (Link)

- Widely used CNC Plasma Cutting Machine for sheet metal kitchenware components decoration industry | Alibaba.com (Link)

- How Far is the Gap Between Domestic and International Advanced Cutting Machines?, Equipment Zone, Curtain Wall Network (Link)

- Plasma Cutter Industry Data Report – Market Size, Price Trends, Brand Share Research_Analysis (Link)

- [PDF] Jasic Technology (300193.SZ) (Link)

- A-Share – Research Report Details – Sina (Link)

- Is Industrial Cutter Foreign Trade Easy? Export Situation? How to Promote Foreign Trade? – Zhihu Column (Link)

- Plasma Cutting Machine Market Size and Growth Analysis (2032) – Global Market Insights (Link)

- 2023-2029 Global CNC Flame Plasma Cutter Industry Research and Trend Analysis Report – Zhihu (Link)

- Is Cutter Foreign Trade Easy? Overseas Market Size? Required Standards or Certifications? Export… (Link)

- Chengdu Huayuan Official Website | Huayuan Welder | Plasma Cutter | Gas… (Link)

- Fabrication: CNC Laser, Waterjet, Plasma, Welding | Cheap Chinese Plasma Cutters | Practical Machinist (Link)

- [Focus] Plasma Cutters Have Excellent Comprehensive Performance, Vast Market Demand Space (Link)

- 2023 Top Ten Plasma Cutter Brand Rankings_Report Hall (Link)

- Which Brand of CNC Plasma Cutter is Good? What Brand of CNC Plasma Cutter is Easy to Use? (Link)